Is it safe to say that you are battling to monitor damages to your property or possessions for insurance claims? Look no further, as we have the ideal answer for you – an insurance damage report template.

At the point when you experience damage to your home, vehicle, or individual possessions, it tends to be overpowering to recall every one of the subtleties and precisely report them to your insurance organization. This is where an insurance damage report template proves to be useful. This template permits you to methodically archive all the fundamental data about the damage, making the case cycle a lot smoother.

Our insurance damage report template incorporates segments for recording subtleties like the date and season of the episode, the reason for the damage, a depiction of the damage, and any quick move initiated. You can likewise connect photographs or recordings of the damage to give visual proof to help your case.

Complete Manual for Utilizing the Insurance Damage Report Template: Free Printable

In the fallout of mishaps or unanticipated occasions, reporting damages is critical for insurance claims. Whether it’s a fender bender, property damage, or some other occurrence covered by insurance, having a point-by-point damage report can smooth out the case cycle and guarantee fair pay. To work on this errand, numerous people and organizations depend on insurance damage report templates. In this aide, we’ll dig into the advantages of utilizing an insurance damage report template and give bits of knowledge into actually using the Insurance Damage Report Template, accessible for free.

Grasping the Significance of Documentation in Insurance Claims

Exact documentation is the foundation of effective insurance claims. While recording a case, insurance organizations require proof of damages to survey the degree of obligation and decide suitable remuneration. Without appropriate documentation, inquirers might experience postponements or debates, prompting disappointments and likely monetary misfortunes.

Advantages of Utilizing an Insurance Damage Report Template

- Structured Data Collection: A very much-planned template prompts clients to give fundamental subtleties deliberately, it is disregarded to guarantee no critical data. This organized methodology improves the culmination and exactness of the damage report.

- Time Efficiency: With a pre-organized template, people can save time by filling in important data as opposed to making a report without any preparation. This effectiveness is especially important during unpleasant circumstances where brief reporting is fundamental.

- Consistency: Utilizing a normalized template keeps up with consistency across different reports, making it more straightforward for insurance agents to survey and handle claims. Consistency in reporting lessens disarray and upgrades the believability of the case.

Presenting the Insurance Damage Report Template: Free Printable

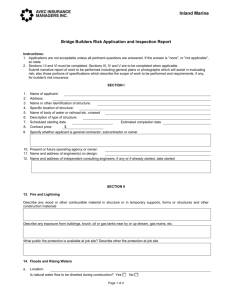

Our free printable Insurance Damage Report Template is intended to improve the documentation interaction for people and organizations the same. This easy-to-understand template envelops all fundamental segments expected for a thorough damage report, including:

Area 1: Petitioner Information

- Name

- Contact Subtleties

- Strategy Number

Area 2: Occurrence Details

- Date and Season of Occurrence

- Area

- Portrayal of the Occurrence

Area 3: Portrayal of Damages

- Nitty Gritty Portrayal of Damaged Property

- Seriousness of Damage

- Assessed Fix Expenses

Area 4: Supporting Documentation

- Connections: Photographs, Recordings, or Other Proof

- Witness Articulations (if relevant)

Get also: Plumbers Report for Insurance Template

Damage Insurance Report Template – Your Roadmap to Recovery

Are you tired of the mundane task of filling out endless insurance damage reports? Do you find yourself at a loss for words when trying to describe that suspicious dent on your car or the unexplainable scratch on your beloved coffee table? Fear not, dear reader, for the insurance damage report template is here to save the day – or at least provide some much-needed comic relief.

Let’s take a journey through the often bizarre and nonsensical world of insurance damage reports, where the truth is stranger than fiction and the template is your trusty sidekick in navigating the treacherous waters of insurance claims.

- The Tale of the Mysterious Scratch: Have you ever found yourself staring at a scratch on your car, wondering how on earth it got there? Was it the work of a mischievous squirrel with a penchant for vandalism, or perhaps a rogue shopping cart on a mission of destruction? Fear not, for the insurance damage report template is here to help you craft a story so outlandish and absurd that even the most skeptical insurance adjuster will be left scratching their head in disbelief.

- The Case of the Vanishing Furniture: Ever discovered a missing piece of furniture in your home, only to later find it clandestinely disguised as a pile of rubble in the corner of your living room? Cue the Damage Insurance Report Template, which will walk you through the steps of reporting the mysterious disappearance of your beloved coffee table with all the seriousness and gravitas it deserves – or doesn’t deserve, depending on how you look at it.

- The Legend of the Phantom Pothole: Ah, the dreaded pothole – the bane of every driver’s existence. But what happens when said pothole mysteriously disappears into thin air, leaving only a trail of destruction in its wake? Enter the insurance damage report template, which will guide you through the process of reporting the inexplicable vanishing act of the phantom pothole with all the eloquence and finesse of a Shakespearean tragedy.

In conclusion, the insurance damage report form template may not be the hero we deserve, but it’s certainly the hero we need in our never-ending quest for insurance claim justice. So next time you find yourself grappling with the absurdity of the insurance world, remember to turn to the Damage Insurance Report Template for some much-needed comic relief – and maybe, just maybe, a happy ending to your insurance woes.

Insurance Loss Report Template – Get the Compensation You Deserve

In the domain of insurance, effectiveness and precision are central. Whether you’re an old pro or simply beginning, having a solid template for insurance loss reports can be a distinct advantage. Here, we’ll dive into the significance of such a template and give you a complete manual to smooth out your reporting cycle.

Why You Want an Insurance Loss Report Template?

An insurance loss report fills in as an essential record in the case cycle. It frames the subtleties of an episode, including the date, time, area, parties included, and degree of the loss. Having a normalized template guarantees consistency across reports, limits blunders, and facilitates the handling of cases. Moreover, it gives a reasonable design to social event pertinent data, which can be particularly helpful during distressing circumstances.

Key Parts of a Successful Insurance Loss Report Template

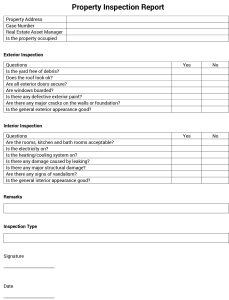

- Header Section: Start with a header containing the name of the insurance organization, strategy number, and guarantee number for simple reference.

- Incident Details: Archive the date, time, and area of the occurrence. Incorporate explicit subtleties like the reason for loss, depiction of harms, and any wounds maintained.

- Witness Information: If pertinent, assemble contact data for observers of the occurrence. Their declarations can give important experiences and certify the subtleties of the report.

- Claimant Information: Record the name, contact subtleties, and strategy data of the inquirer. This guarantees exact correspondence and works with the case cycle.

- Loss Assessment: Give a careful evaluation of the loss, including gauges for property harm, clinical costs, and some other related costs.

- Photos and Documentation: Consolidate photographs, recordings, and other applicable documentation to help the data given in the report. Visual proof can reinforce the legitimacy of the case.

- Signature and Date: Finish up the report with a segment for marks from the guaranteed party and the case agent. This affirms settlement on the subtleties of the report and the subsequent stages in the case cycle.

Advantages of Utilizing a Template

- Consistency: By following a normalized template, you guarantee consistency across all reports, decreasing the gamble of disparities or oversights.

- Time Savings: A pre-planned template smoothes out the reporting system, permitting you to zero in on your significant investment on other basic errands.

- Further developed Accuracy: With predefined segments and prompts, there’s less wiggle room, guaranteeing that all applicable data is caught precisely.

- Improved Professionalism: Introducing efficient, proficient-looking reports ponders decidedly your ability and scrupulousness.

Ways to Boost the Adequacy of the Template

- Provide Precise Information: Guarantee all subtleties that went into the template are exact and reliable with other documentation, for example, police reports or witness articulations.

- Include Supporting Evidence: Supplement the damage report with photos, recordings, or whatever other proof that reinforces your case. Visual documentation can fundamentally support your case.

- Be Thorough: Rule out equivocalness by giving exhaustive depictions of damages and the conditions encompassing the occurrence. The more definite your report, the simpler it is for insurance agents to assess your case.

Get also: Insurance Incident Report Template Free Printable

Conclusion

In the complicated universe of insurance claims, having a completely ready damage report can have a significant effect. By using the Insurance Damage Report Template given free of charge, people and organizations can smooth out the case cycle, improve the probability of fair pay, and limit the pressure related to recording insurance claims. Try not to take a risk with your monetary future – download our template today and guarantee your cases are upheld by exhaustive documentation.